The 10 Most Important Cryptocurrencies Other Than Bitcoin

تم النشر بتاريخ 22-11-21 The 10 Most Important Cryptocurrencies Other Than Bitcoin ، ، ،

The 10 Most Important Cryptocurrencies Other Than Bitcoin ، ، ،

هذا العمل ينتمي الى التصنيفات التالية من الفيديو، لذا يمكنك الاطلاع على الاعمال الأخرى التي تلتقي مع The 10 Most Important Cryptocurrencies Other Than Bitcoin وفق هذه التصنيفات

اخبار فنية سينمائية

قصة The 10 Most Important Cryptocurrencies Other Than Bitcoin

Bitcoin has not just one top-of-the-line pioneer, presenting an inundation of digital currencies based on a decentralized appropriated framework, it's gotten the genuine norm for cryptographic types of cash, moving and always creating a multitude of fans and side undertakings.

KEY TAKEAWAYS

Past that, the field of cryptographic types of cash has broadened essentially since bitcoin was pushed longer than 10 years back, and the accompanying mind-blowing mechanized token may be issued day, for all anyone in the cryptosystem knows. Bitcoin continues standing apart of computerized types of cash, similarly to market capitalization, customer base, and conspicuousness. Virtual financial norms, for instance, Ethereum and XRP, which are being used more for large business courses of action, have moreover gotten notable. Some altcoins are being embraced for unmatched or pushed features versus bitcoins.

What Are Cryptocurrencies?

Before we explore a bit of this choice of Bitcoin, what about we venture back and rapidly review what we mean by terms like computerized cash and altcoin. A digital currency, broadly described, is virtual or progressed money that shows up as tokens or "coins." While some cryptographic forms of money have meandered into the actual world with charge cards or various exercises, the immense predominant part remains absolutely insignificant. The "crypto" in digital forms of money implies jumbled cryptography. Which considers the creation and planning of mechanized financial norms and their trades across decentralized frameworks. Near this critical "crypto" feature of these money-related principles is a normal guarantee to decentralization. Digital forms of money are normally developed as code by bunches who work in instruments for issuance (consistently, regardless of the way that not by and large, through a methodology called "mining") and with various controls. Cryptographic forms of money are constantly expected to be freed from government control and control. Regardless of the way that as they have grown dynamically notable this essential piece of the business has encountered cruel analysis. The money-related principles showed after bitcoin are overall called altcoins and have habitually endeavored to present themselves as changed or improved variations of bitcoin. While a segment of these financial structures is less difficult to mine than bitcoin, there are tradeoffs, including more genuine perils invited by lower levels of liquidity, affirmation, and worth upkeep. Underneath, we'll break down presumably the main computerized money norms other than bitcoin. In the first place, be that as it may, a stipulation: it is outlandish for an overview like this to be totally careful. One reason behind this is the route that there are more than 2,000 cryptographic types of cash in presence as of January 2020. A critical number of those tokens and coins value gigantic unmistakable quality among a submitted (expecting to be nearly nothing, now and then) organization of allies and monetary trained professionals. Past that, the field of cryptographic forms of money is persistently developing, and the accompanying staggering progressed token may be released tomorrow. For all, anyone in the crypto network knows. While bitcoin is extensively seen as a pioneer in the domain of computerized monetary forms, specialists get various procedures for surveying tokens other than BTC. It's typical, for instance, for agents to characteristic a great deal of importance to the situating of coins similar with one another to the extent market top. We've determined this into our idea, yet there are various reasons why a high-level token may be associated with the overview moreover.

-

Ethereum (ETH)

Ethereum is the primary option of bitcoin. We have since a long time ago recorded very nearly 10, however, Ethereum is the top in this rundown. Ethereum is a decentralized programming stage. It empowers Smart Contracts and Decentralized Applications to be assembled and run with no vacation, misrepresentation, control from outsiders. The applications on Ethereum are run on its establishment unequivocal cryptographic token. The Ethereum stage is created by some extra gainful element. Ether, dispatched in 2015, is correct now the second-greatest computerized coin by promoting top after bitcoin, disregarding the way that it waits behind the dominating advanced money by an enormous edge. As of January 2021, ether's exchange top is around 1/10 the size of bitcoin's. During 2014, Ethereum moved a pre-bargain for ether which got an amazing response; this helped with presenting the age of the basic coin offering (ICO). As confirmed by Ethereum, it might be related to "organize, decentralize, protected and trade really anything." Following the attack on the DAO in 2016, Ethereum was part of Ethereum (ETH) and Ethereum Classic (ETC). As of Jan. 8, 2020, Ethereum (ETH) had a market top of $15.6 billion and a for each emblematic assessment of $142.54.

-

Wave (XRP)

Wave is a continuous overall settlement coordinate that offers second, certain, and ease worldwide portions. The wave was dispatched in 2012, in the wake of dispatching Ripple taken and made a decent fundamental advance to work with a bank. Wave money marge more framework. Without a doubt, the whole of Ripple's XRP tokens were "pre-mined" before dispatch, suggesting that there is no "creation" of XRP after some time, simply the introduction and removal of XRP from the market nimbly according to the framework's guidelines. Thusly, Ripple isolates itself from bitcoin and various distinctive altcoins. Since Ripple's design doesn't need mining, it diminishes the usage of handling force and cutoff points put together inertness. Up until this point, Ripple has seen achievement with its current strategy; it stays quite possibly the most attractive automated financial principles among regular budgetary establishments looking for ways to deal with upset cross-periphery portions. It is similarly at present the third-greatest advanced money on earth by overall market top. As of Jan. 8, 2020, Ripple had a market top of $9.2 billion and a for each emblematic assessment of $0.21.7

-

Litecoin (LTC)

Litecoin, dispatched in 2011, was among the essential advanced monetary forms to continue in the steps of bitcoin and has now and again been implied as "silver to bitcoin's gold." It was made by Charlie Lee, an MIT graduate, and past Google engineer. Litecoin relies upon an open-source overall portion course of action that isn't obliged by any central position and uses "script" as a proof of work, which can be decoded with the help of CPUs of buyer grade. Regardless of the way that Litecoin looks like bitcoin according to different perspectives, it has a speedier square age rate and thusly offers a faster trade confirmation time. Other than fashioners, there are a creating number of transporters who recognize Litecoin. As of Jan. 8, 2020, Litecoin had a market top of $3.0 billion and a for each representative worth of $46.92, making it the 6th biggest digital currency on the planet.

-

Tie (USDT)

The tie was one of the first and generally mainstream of a gathering of a get-together of implied stablecoins, digital forms of money which plan to fix their sensible worth to money or another external reference point to lessen flightiness. Since most automated money-related norms, even critical ones like bitcoin, have experienced visit seasons of passionate unconventionality, Tether and diverse stablecoins attempt to smooth out esteem changes to attract customers who may some way or another or another be cautious. Dispatched in 2014, Tether portrays itself as "a blockchain-enabled stage expected to energize the use of fiat financial norms electronically."10 Effectively, this cryptographic cash licenses individuals to utilize a blockchain organize and related developments to execute in standard financial principles while restricting the flimsiness and multifaceted nature routinely associated with cutting edge money-related structures. On Jan. 8, 2020, Tether was the fourth-greatest advanced cash by exhibit top, with a full-scale market top of $4.6 billion and a for each representative assessment of $1.00.

-

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) holds a huge spot in the chronicled setting of altcoins considering the way that it is one of the soonest and best hard forks of the first bitcoin. In the cryptographic cash world, a fork occurs as the outcome of conversations and disputes among architects and backhoes. As a result of the decentralized thought of modernized financial guidelines, rebate changes to the code essential the token or coin reachable should be settled on in light of general understanding; the instrument for this system varies as demonstrated by the particular digital currency. Exactly when different gatherings can't go to an agreement, at times the high-level cash is a part, with the first remaining reliable with its one-of-a-kind code and the other copy beginning life as another type of the previous coin, complete with changes to its code. BCH began its life in August of 2017 as a result of one of these parts. The conversation which provoked the creation of BCH had to do with the issue of flexibility; the Bitcoin orchestrate has a demanding limit on the size of squares: one megabyte (MB). BCH constructs the square size from one MB to eight MB, with the contemplation being that greater squares will think about speedier trade times. It is like manner carries out various upgrades, also, including the removal of the Segregated Witness show which impacts square space. As of Jan.

-

(LIBRA)

Perhaps the most-publicized digital currencies are one that, as of January 2020, as of now can't attempt to dispatch. By mid-2018, pieces of tattle surrounded that web-based life goliath Facebook, Inc. (FB) was developing its own computerized cash. Given Facebook's impossible overall reach and the potential for colossal volumes of an exchange over its establishment, the cryptographic cash world had since a long time back assessed that the web-based systems administration titan may dispatch its own high-level token. Pieces of tattle were formally attested on June 18, 2019, when Facebook released the white paper for Libra. The restrictive dispatch date for the token is later in 2020, as Facebook has zeroed in on sorting out regulatory preventions before dispatch. Libra will be coordinated somewhat by another Facebook helper, the financial organization's outfit Calibra. At the point when Libra dispatches, it makes sure to acquire enormous proportions of thought from that inside (and outside of) the computerized cash circle.

-

Monero (MXR)

Monero is a protected, private and untraceable money. This open-source digital money was dispatched in April 2014 and after a short time spiked remarkable excitement among the cryptography organization and fans. The progression of this computerized cash is thoroughly blessing-based and network-driven. Monero has been dispatched with a strong focus on decentralization and flexibility, and it engages complete security by using an unprecedented technique called "ring marks." With this technique, there is by all accounts a social event of cryptographic imprints including at any rate one real part, yet since they all appear to be significant, the real one can't be limited. Considering momentous security frameworks like this, Monero has made something of a hostile reputation: it has been associated with criminal errands the world over. Regardless, whether or not it is used for worthy or debilitated, there's no rejecting that Monero has familiar critical inventive advances with the computerized cash space. As of Jan. 8, 2020, Monero had a market top of $994.0 million and a for each representative assessment of $57.16.

-

(EOS)

Alongside Libra, quite possibly the most forward-thinking progressed financial structures to make our summary is EOS. Dispatched in June of 2018, EOS was made by digital money pioneer Dan Larimer. Before his work on EOS, Larimer set up the high-level money exchange Bitshares similarly to the blockchain-based online life stage Steemit. Like distinctive cryptographic types of cash on this overview, EOS is organized there, so it offers a phase on which architects can create decentralized applications. EOS is noteworthy for various reasons, be that as it may. Most importantly, its underlying coin offering was one of the longest and by and large profitable ever, gathering together a record $4 billion or so in monetary expert resources through freely supporting undertakings bearing a year. EOS offers an assigned proof-of-stake framework which it needs to have the choice to bring to the table versatility past its adversaries. EOS includes EOS.IO, similar to the functioning game plan of a PC and going probably as the blockchain coordinate for the mechanized money, similarly as EOS coins. EOS is moreover reformist because of its shortfall of a mining segment to convey coins. Or maybe, square producers make squares and are repaid in EOS tokens subject to their creation rates. EOS consolidates an astounding course of action of rules to regulate this technique, with the musing being that the framework will finally be more vote-based and decentralized than those of various advanced monetary standards. As of Jan. 8, 2020, EOS had a market top of $2.7 billion and a for each emblematic assessment of $2.85.

-

Bitcoin SV (BSV)

Bitcoin SV (BSV), with "SV" for the present circumstance signifying "Satoshi Vision," is a hard fork of Bitcoin Cash. In this sense, BSV is a fork of the main Bitcoin organization. An orchestrated framework redesign for November of 2018 achieved an all-inclusive conversation among mining and making bunches in the BCH social class, inciting a hard fork and the creation of BSV. Specialists of Bitcoin SV suggest that this cryptographic cash restores Bitcoin creator Satoshi Nakamoto's interesting show, while moreover mulling over new headways to extend security and to think about versatility. Bitcoin SV planners also coordinate security and fast trade dealing with times. As of Jan. 8, 2020, BSV had a market top of $2.1 billion and a for each emblematic assessment of $114.43.

-

Binance Coin (BNB)

Binance Coin (BNB) is the police description of the Binance digital cash exchange platform. Set up in 2017, Binance has promptly risen to transform into the greatest exchange of its sort all around to the extent of the overall trading volume. The Binance Coin token licenses Binance customers to trade numerous particular advanced types of cash successfully on the Binance stage. BNB is used to energize trade charges on the exchange and can in like manner be used to pay for explicit items and adventures, including travel costs and anything possible from that point. As of Jan. 8, 2020, BNB had a market top of $2.3 billion and a for each representative assessment of $14.71.

End:

All things considered, Bitcoin has been the ruler of digital currencies since the start. As a rule, it is utilized as an equivalent for cryptographic forms of money. We can clearly say that bitcoin is setting down deep roots and that it isn't going anyplace. Notwithstanding, there are a ton of discussions about what will be the best coins later on? As per Yahoo, there are four digital forms of money to put resources into 2020: Bitcoin, Etherium, NEO, and EOS.

فيلم Red One 2024 ريد وان

فيلم Red One 2024 ريد وان

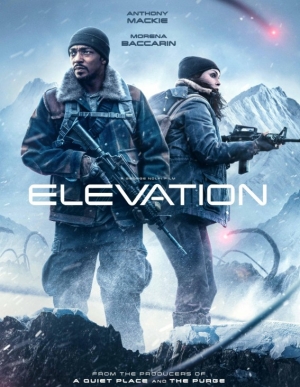

فيلم Elevation 2024 ارتفاع

فيلم Elevation 2024 ارتفاع

فيلم قطار بوسان 3 Train to Busan 3 : REDEMPTION (2024)

فيلم قطار بوسان 3 Train to Busan 3 : REDEMPTION (2024)

فيلم The Beast Within 2024 الوحش في الداخل

فيلم The Beast Within 2024 الوحش في الداخل

فيلم Kalki 2898 AD 2024 كالكي 2898 ميلادي

فيلم Kalki 2898 AD 2024 كالكي 2898 ميلادي

فيلم Harold and the Purple Crayon 2024 هارولد وقلم التلوين الأرجواني

فيلم Harold and the Purple Crayon 2024 هارولد وقلم التلوين الأرجواني